The power of compound interest

You can achieve significant financial success by investing even small amounts if you do it regularly. Consistent investments allow you to fully leverage the power of compound interest.

This is related to the principle of compound interest. The effect of compound interest can be compared to the growth of a snowball: it grows as it moves, gaining speed and mass. Similarly, your investments can grow significantly over time. It is important to remember that stability and discipline in investing are key factors that will help increase your wealth and achieve your financial goals.

Compound interest plays a crucial role in financial planning. In this article, we will discuss how it works, explore the main strategies for its application, and examine the factors that influence its effectiveness. We will also look at the risks and limitations, so you can better assess your investment decisions.

Definition of Compound Interest

Compound interest is a financial term describing the process of calculating interest not only on the initial principal but also on the accumulated interest. This leads to exponential growth of investments or debt over time.

Difference Between Compound and Simple Interest

Compound and simple interest are two ways of calculating income on invested funds. Simple interest is calculated only on the principal amount, providing linear growth, while compound interest grows exponentially, as it includes not only the principal but also the accumulated interest. The key differences between compound and simple interest are:

Method of Calculation

Rate of Growth

Effectiveness

Advantages of Compound Interest

Real-Life Scenario Examples

Let’s consider a few real-life examples that demonstrate the power of compound interest:

- 1Stock Investments: With an average annual return of 8%, a €10,000 investment could grow to €100,627 over 30 years.

- 2Retirement Savings: Monthly contributions of €500 with an annual return of 6% could grow to €830,000 over 35 years.

- 3Savings Account: Even with a modest annual interest rate of 3%, €10,000 could grow to €18,061 over 20 years.

Long-Term Financial Benefits

Compound interest offers a range of long-term financial advantages:

Accelerated Capital Growth

One of the key benefits of compound interest is the exponential growth of capital. Let’s compare simple and compound interest:

Year | Simple (10%) | Compound (10%) |

|---|---|---|

1 | 11 000 € | 11 000 € |

5 | 15 000 € | 16 105 € |

10 | 20 000 € | 25 937 € |

20 | 30 000 € | 67 275 € |

The longer you invest, the greater the advantage of compound interest, as the effect of reinvesting and accumulating interest on interest becomes more significant. This exponential growth can dramatically increase the value of your investment in the long run.

Factors Affecting the Effectiveness of Compound Interest

The effectiveness of compound interest depends on several factors. Understanding these factors will help you manage your investments wisely and maximize your returns. Let's take a closer look at each of these factors:

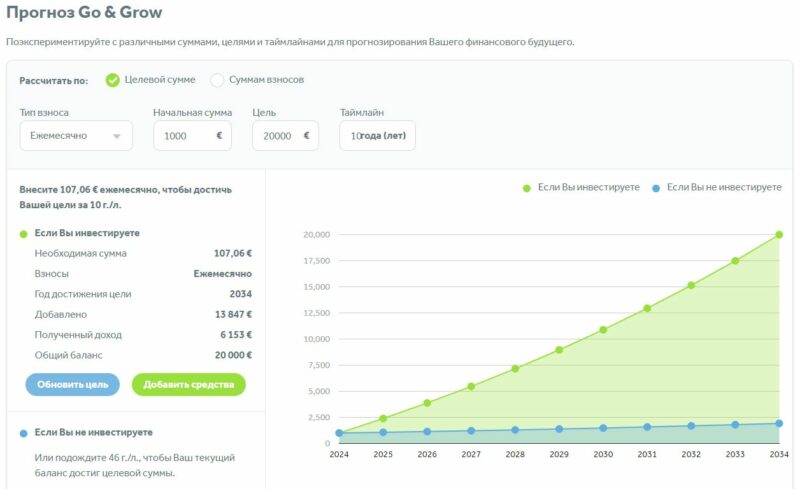

Bondora G&G

Frequency of Interest Calculation

The frequency of interest calculation determines how often your earnings are added to the principal. The more frequently interest is calculated, the faster your capital grows through the reinvestment of earnings.

- 1Annual Compounding: If interest is added to your account once a year, your capital grows slowly. For example, €10,000 at an annual interest rate of 5% will grow to €12,762 over 5 years.

- 2Quarterly Compounding: With interest calculated 4 times a year, your capital grows faster. The same €10,000 at an annual interest rate of 5% will grow to €12,834 over the same period.

- 3Monthly Compounding: In this case, interest is calculated 12 times a year. €10,000 will grow to €12,858 over 5 years, which is higher than with annual compounding.

- 4Daily Compounding: The maximum frequency of interest calculation. In this case, the same €10,000 will grow to €12,882 over 5 years.

Thus, the more frequently interest is compounded, the greater the effect of compound interest.

Regular Additional Contributions

Regular contributions increase your capital faster than if you simply left an initial amount.

- 1Lump-Sum Investment: You invest €10,000 at an annual interest rate of 6% for 20 years. After 20 years, you will have €32,071.

- 2Monthly Contributions: If you contribute an additional €100 per month, your capital will grow to €79,058 over the same 20 years. Regular contributions significantly increase the final amount.

- 3Increasing Contributions Over Time: Starting with €100 per month and increasing the amount by 5% annually, after 20 years you will accumulate €100,238.

Thus, even small regular contributions can significantly accelerate capital growth.

Initial Deposit Amount

The initial deposit amount establishes the base for capital growth. The larger the initial sum, the greater the income you can earn through compound interest.

- 1Small Initial Deposit: If you invest €1,000 at an annual interest rate of 7% for 30 years, you will have €7,612.

- 2Large Initial Deposit: Investing €10,000 under the same conditions will result in €76,122. The difference in the initial amount leads to significant variations in the final capital.

- 3Lack of Initial Capital: If you start without an initial deposit and rely only on monthly contributions, your capital will still grow, but at a slower pace.

Thus, the size of the initial deposit has a significant impact on the final result.

Investment Timeline

Time is one of the most important factors affecting the effectiveness of compound interest. The longer you keep your money invested, the more opportunities there are for it to gro

- 1Short-Term: By investing €5,000 at 8% for 5 years, you will receive €7,346.

- 2Medium-Term: The same €5,000 will grow to €15,872 over 15 years.

- 3Long-Term: The same amount of €5,000 will grow to €50,313 over 30 years. The difference of 25 years leads to nearly a 7-fold increase in capital.

The more time your capital has to grow, the more significant the result.

Interest Rate

The interest rate determines how quickly your capital grows. Even a small difference in the interest rate can lead to significant changes in the final amount.

- 1Low Interest Rate (3%): At an annual interest rate of 3%, €10,000 will grow to €20,924 over 25 years.

- 2Average Interest Rate (6%): At an annual interest rate of 6%, the same amount will grow to €42,919 over 25 years.

- 3High Interest Rate (10%): At an annual interest rate of 10%, your €10,000 will grow to €108,347 over 25 years.

Even a small increase in the interest rate can significantly impact the growth of your capital in the long term.

P2P Lending

6.75% Annual Return with P2P Lending on Bondora Go & Grow

Bondora Go & Grow: Simple & Smart P2P LendingBondora Go & Grow is a hassle-free, automated investment platform designed by [...]

Understanding these factors will help you manage your investments more effectively and maximize the benefits of compound interest. The choice of compounding frequency, regular contributions, initial deposit size, investment duration, and interest rate — all of these must be considered when planning your financial goals.

Compound interest is a powerful financial tool that can significantly grow your investments over time. Understanding its principles, benefits, and application in investments can be the key to achieving your long-term financial goals. It is important to consider the factors that influence the effectiveness of compound interest and use strategies to maximize its effect.

Start applying the power of compound interest today. Invest regularly, reinvest your earnings, and be patient. Keep in mind the potential risks and limitations, but don't let them stop you from using this powerful tool to build wealth. Your financial future depends on the decisions you make today.